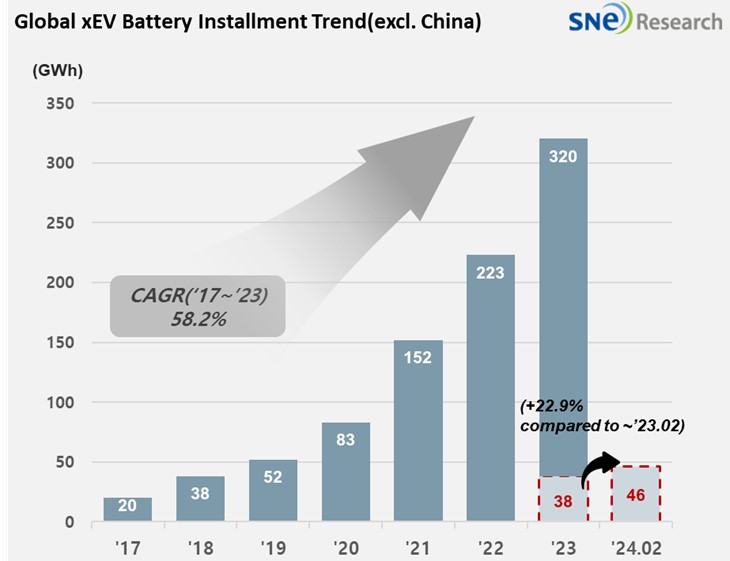

From Jan to Feb 2024, Non-Chinese Global[1] EV Battery Usage[2] Posted 46.2GWh, a 22.9% YoY Growth

- K-trio accounted for 45.5% M/S from Jan to Feb 2024

Battery installation for global electric vehicles (EV, PHEV, HEV) excluding the Chinese market sold from January to February in 2024 was approx. 46.2GWh, a 22.9% YoY growth.

(Source: Global EV and Battery Monthly Tracker – Mar 2024, SNE Research)

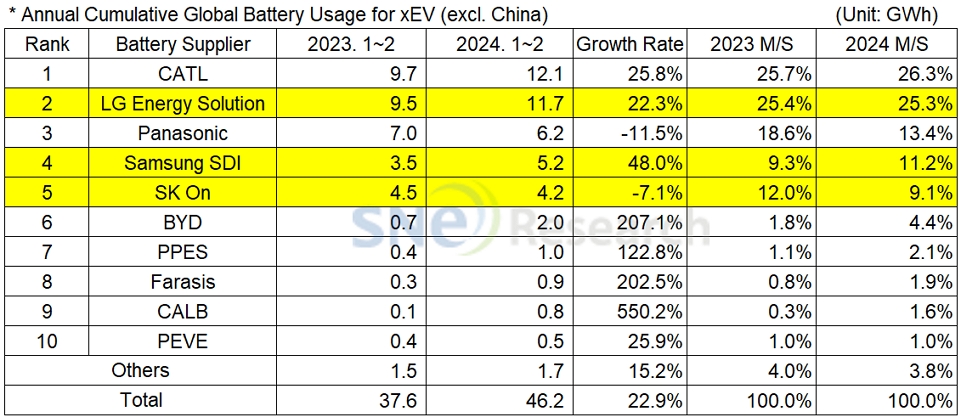

In the ranking of battery usage for electric vehicles, the K-trio battery makers all ranked within the top 5. LG Energy Solution ranked 2nd with a 22.3% (11.7GWh) YoY growth. Samsung SDI showed the highest growth of 48.0% (5.2GWh) among the K-trio, while SK On posted a -7.1%(4.2GWh) YoY growth.

(Source: Global EV and Battery Monthly Tracker – Mar 2024, SNE Research)

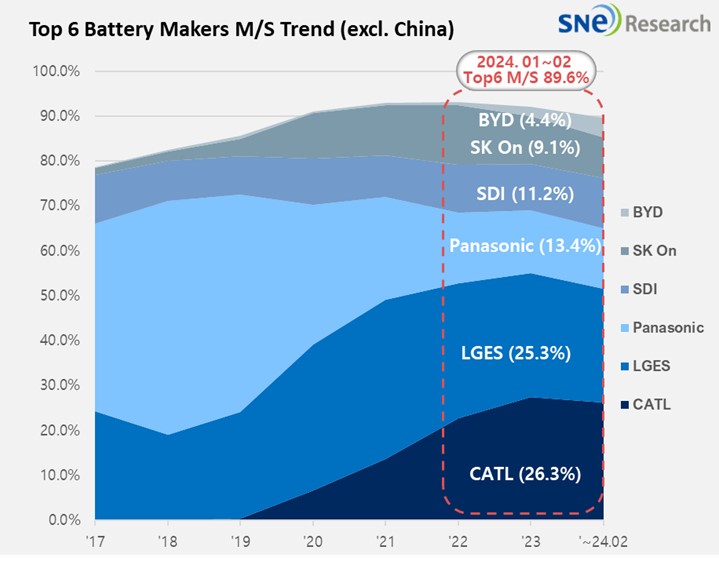

The combined shares of K-trio recorded 45.5%, a 1.2%p YoY decline. If we look at the usage of K-trio battery in line with the sales volume of electric vehicles, Samsung SDI maintained a high growth thanks to solid sales of BMW i4/5/7 and Audi PHEV in Europe and high sales of Rivian R1T/R1S/EDV in North America. Although SK On had its battery used at a similar level to that of the same period of last year, it posted a degrowth due to slow sales of Hyundai IONIQ 5 and KIA EV6. However, as Mercedes EQ line-up has been sold steady and the global sales of KIA EV9 has expanded, SK On is expected to return to an upward trajectory. LG Energy Solution’s growth was led by sales of bestselling vehicles in Europe and North America such as Tesla Model 3/Y, Ford Mustang Mach-E, and GM Lyriq.

Panasonic saw 6.2GWh of its battery used from Jan to Feb 2024, posting a 11.5% YoY degrowth. The degrowth of Panasonic, one of the major battery suppliers to Tesla, was mainly led by a temporary slowdown in sales due to partial change in Model 3. On the other hand, it has most of its battery usage installed in Tesla Model Y in the North America. As it has been reported that Panasonic would release advanced 2170 and 4680 cells, it is expected to expand its market share mostly focusing on Tesla.

CATL, which has been rapidly expanding its share even in the non-China market, captured the leading position with a continuous high growth of 25.8% (12.1GWh) YoY. CATL’s battery is installed to Tesla Model 3/Y(made in China and exported to Europe, North America, and Asia) as well as vehicles made by major OEMs such as BMW, MG, Mercedes, and Volvo. With its battery installed to KONA, Niro, Kia Ray EV, CATL has been gradually expanding its influence in the Korean domestic market.

(Source: Global EV and Battery Monthly Tracker – Mar 2024, SNE Research)

The slowdown in growth of EV market is analyzed to be mainly influenced by the market entering the so-called Chasm zone as the demand from early adapters does not exist anymore. Such slowdown in the EV market started to affect the entire secondary battery industry, making some of the industry players, who have stayed in an upward trajectory for a long time, experience a degrowth. Amidst the price competition among OEMs to weather through the chasm period, battery makers have been trying to expand their product portfolios including high-voltage mid-nickel and LFP batteries to respond to the changing EV market of which focus shifted from performance to price. Furthermore, to prepare for ‘quantum jump’ in the upcoming golden era of electric vehicles, battery makers are expected to seek for qualitative growth through development of next-generation battery such as all-solid-state battery.

[2] Based on battery installation for xEV registered during the relevant period.